Impact investing in Africa, Central Asia, and Latin America

Cultivating Inclusive Growth

About US

AV Ventures is ACDI/VOCA’s for-profit impact investment subsidiary.

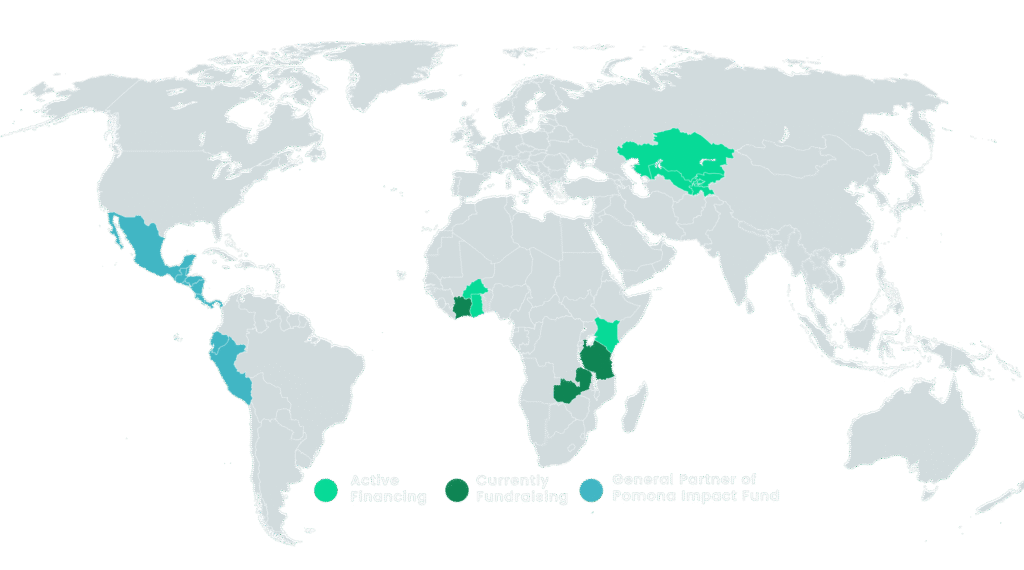

We provide innovative, catalytic financing to small and medium enterprises (SMEs) and financial institutions (FIs) with strong potential for growth and impact in Africa, Central Asia, and Latin America. Such investments contribute to more competitive, resilient, and inclusive market systems and provide better economic opportunities for marginalized communities.

By building off the strong foundations and deep networks developed by ACDI/VOCA through 60+ years of work in target markets, we strive to create systemic change through our investments. As a result, we can go beyond traditional impact investing to create returns and impact where traditional investors stop short – at early and growth stages – in lower income countries and underfunded sectors.

At AV Ventures, financial innovation is part of our DNA. This is why we offer custom-based financial products (such as revenue-based loans and other mezzanine structures) to better support the funding needs of our portfolio companies.

Our Presence

Let's Talk Numbers

Portfolio companies

Clients served by portfolio companies

Capital raised

portfolio companies

It All Starts With An Idea

CHECK OUT THE COMPANIES ALREADY TRANSFORMING MARKETS.

AV Ventures’ investee companies across our investment funds are high-growth, high-impact companies with dynamic, entrepreneurial leadership. AV Ventures’ portfolio partners benefit from innovative, risk-sharing financial products, and a growth-enhancing approach to portfolio management driven by our aligned incentives.

01.

The Impact for Kenya (INK) Fund expands lending in underserved northern counties of Kenya.

02.

With AV Ventures Ghana (AVVG) Fund, we have built a successful pilot fund which creates a viable path towards our long-term vision of a “bridge to investability” and a regional West Africa Fund.

03.

04.

Central Asia Impact Fund (CAIF) is managed by AV Ventures and AV Frontiers, an investment management firm based in Bishkek, Kyrgyz Republic.

How to Partner

AV Ventures welcomes partnerships that align with our mission of catalyzing inclusive growth in emerging markets. We work with two primary groups of partners:

Investors in AV Ventures Funds

High-Growth Enterprises

At AV Ventures, we value collaboration with both investors and enterprises to create sustainable, market-driven solutions. To explore partnership opportunities, please contact us with relevant details so that we can guide you to the appropriate team.

Testimonials

What Our Partners Are Saying

Nancy Kinyanjui

CEO, Centenary Microenterprises Limited

Aselia Kupueva

Co-founder of Kupuev Academy

Abubakar Aidarus

CEO of Solargen Technologies Ltd